Each new stage of life offers new insights, perspectives and hopefully wisdom. Our family is on the verge of our second child’s wedding. We have been blessed with exceptional people who have joined our family through marriage. This makes the occasion an incredible celebration. It really is one of life’s greatest blessings. Ask yourself, Do You Have 2 Classes of Children in Your Family?

The 7 Forms of Generosity

Think of the last time you were the recipient of an act of kindness or generosity. How did it make you feel? Did it brighten up your day? Did you tell someone about it? Did it inspire you to pass kindness or generosity on to someone else? We cannot receive an act of kindness or generosity and not be positively impacted!

What’s the Purpose of All Your Money

Have you ever wondered why you have the money you have? You have means but what is its connection to meaning? To put it simply, what is the purpose of your money?

Mitch Anthony of Advisor Insights is a leading trainer for Financial Advisors. A month ago, I spoke at a national conference Mitch was speaking at. I gleaned some important insights from Mitch that I want to pass along.

The most common question I hear from clients is “Will I/do I have enough?” The answer to this question is something we regularly monitor for our clients. Mitch suggests a more valuable question to ask is “Am I managing my money in a way that is improving my life?” This requires the holistic approach our firm provides by addressing investment management, debt management, spending management, risk management, relational management, and financial & estate planning.

Three Keys to Being A Multi-Millionaire

If you believe, as I do, that true wealth is made up of more than just money then you are much, much wealthier than you think. The key to enjoying your wealth is found in these simple steps:

• Stop

• Look, listen, feel, smell, taste

• Enjoy

Are You Leaving a Fraction of What You Could?

Our self-made, independent, North American lifestyle results in each generation basically starting over. Out of ignorance, we make the same mistakes of past generations and miss the incredible wisdom from the life lessons of those generations

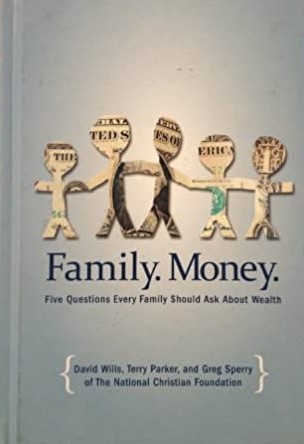

Family. Money. by Greg Wills, David & Parker, Terry & Sperry – National Christian Foundation

Written from a Christian worldview, this book outlines the dynamics of family money & how to avoid the common pitfalls of wealth & inheritance. This is a thought-provoking book from 3 of the country’s leading experts on wealth transfer, David Wills, Terry Parker, and Greg Sperry.

The Truth About Market Lies

If you read the business section of any major newspaper or website in the last month, I’m sure you saw headlines suggesting what would happen in the markets in 2019. There are as many perspectives, as there are articles. Why is that? Because no one knows. So why do we expect someone can predict the future? Why are we always looking for that perfect fund manager?

Why Your Spouse Is Your Most Important Financial Advisor

Your first thought when reading this title might be: “You obviously don’t know my spouse”.

We may not know your spouse but today we will provide insights based on our experience and on statistics that show couples who are both involved in their family finances will do best.

Happy Thanksgiving!

Although we are in the midst of a global pandemic that has been the source of great human loss, massive disruption, forced changes and challenges on most fronts, I find our environment in Canada to be one of the best, if not the best, in the world. I have an extensive list of reasons to be thankful.

Three Questions That Will Extend Your Wealth For Generations

We can have an incredible impact on the people most important to us. Smart families even extend their wealth and legacy through several generations