As the townhouses in my complex started to light up and mall parking lots became packed with shoppers, I realized the holiday season was upon us. This is the season for gift giving, meal planning and social gathering. Families and friends travel far to see each other, longing to connect and slow down. 2022, without a doubt, has been a roller coaster.

Thank You!

Each year I make sure that I reach out on behalf of our team to say Thank You to our clients, the professionals inside and outside of our firm who help us support our clients, our suppliers, our network of advocates, charities & professional organizations, friends of our firm and our families. This list includes some of the best people alive on the planet, we regularly brag about the quality of people we get to serve and those who help us serve. Hopefully, you hear ‘thank you’ from us often.

What’s the Purpose of All Your Money

Have you ever wondered why you have the money you have? You have means but what is its connection to meaning? To put it simply, what is the purpose of your money?

Mitch Anthony of Advisor Insights is a leading trainer for Financial Advisors. A month ago, I spoke at a national conference Mitch was speaking at. I gleaned some important insights from Mitch that I want to pass along.

The most common question I hear from clients is “Will I/do I have enough?” The answer to this question is something we regularly monitor for our clients. Mitch suggests a more valuable question to ask is “Am I managing my money in a way that is improving my life?” This requires the holistic approach our firm provides by addressing investment management, debt management, spending management, risk management, relational management, and financial & estate planning.

Splitting Heirs: Giving Your Money and Things to Your Children Without Ruining Their Lives by Ron Blue

In this book, Ron discusses how the financial wealth you leave behind could be the best thing that ever happened to your loved ones—or the worst. “Inheritance is risky business, often damaging lives, marriages and children. Few of us bring an eternal perspective to leaving money behind or to handling unearned wealth.” – Randy Alcorn.

Are You Leaving a Fraction of What You Could?

Our self-made, independent, North American lifestyle results in each generation basically starting over. Out of ignorance, we make the same mistakes of past generations and miss the incredible wisdom from the life lessons of those generations

Managing God’s Money by Randy Alcorn

Written from a Christian world view. Managing God’s Money is the perfect reference tool for anyone who is interested in gaining a solid biblical understanding of money, possessions, and eternity.

A Generous Life: 10 Steps To Living A Life Money Can’t Buy by David Green

A Generous Life, in this book David guides you through 10 simple but life changing action steps to help you establish a generous mindset, determine where and how much to give, create a legacy plan, and more.

Giving It All Away by David Green with Bill High

Green sees the life of giving as a life of adventure. But it’s a life that pays the best rewards personally, offers a powerful legacy to your family, and changes those you touch.

Your Life…Well Spent by Russ Crosson

Most people want to prosper financially, and in their pursuit of material gain, they often sacrifice the greater goal of posterity. There is a better way to think about money, about one’s life work & legacy.

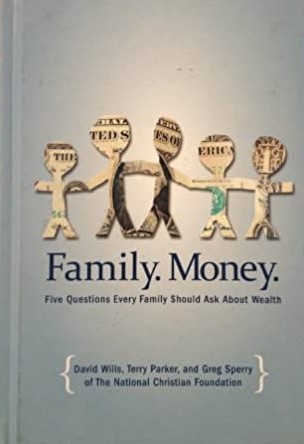

Family. Money. by Greg Wills, David & Parker, Terry & Sperry – National Christian Foundation

Written from a Christian worldview, this book outlines the dynamics of family money & how to avoid the common pitfalls of wealth & inheritance. This is a thought-provoking book from 3 of the country’s leading experts on wealth transfer, David Wills, Terry Parker, and Greg Sperry.

- Page 1 of 2

- 1

- 2