I was on a webinar recently that featured Paul Desmarais III. Paul is the Chairman & CEO of Sagard Holdings ULC and SVP Power Corp. The Desmarais family is one of the richest families in Canada. Three things stood out for me. Click to read our blog to find out what you can learn from Canada’s richest families.

The Most Important Discovery I’ve Made In The Last Decade

I am constantly learning; whether it is from great books (thank goodness for audio books) or great people who I have the privilege of interacting with.

Today, I want to share with you one of the most important discoveries I have made in the last decade.

It has revolutionized my life, reduced my stress, and made life incredibly more enjoyable.

It is called the ‘Belief Matrix’ and it was taught to me by my friend and mentor, Paul Anthes, of R3 Coaching.

How Rich Are You?

It has been reported that when John D. Rockefeller was asked by a reporter “How much is enough?” he responded, “Just a little bit more”.

Although he was one of the most financially successful businesspeople in America, his response resonates with most of us. Regardless of the riches we have accumulated, we all know others in our circles that we feel have accumulated more and we would like to have more.

How To Realize A Massive Return On The Sale Of Your Business

You have spent years, likely decades, overcoming challenges and building a successful business. Congratulations! You have accomplished an amazing feat very few people achieve. However, your greatest challenge may lay before you: successfully transitioning to the next phase of life. Read more to find out How To Realize A Massive Return On The Sale Of Your Business.

How Much Is Enough

I find it interesting that we have a natural discernment of how much is enough for many aspects of our life. This includes the dinner table, although the Thanksgiving dinner table often pushes the limits to that natural discernment, it also includes our limits when grocery shopping or even exercising.

7 Warning Signs Your Business Succession Will Likely Fail

History has proven that 70% of family businesses will not transition to the next generation. Will yours be one of the statistics? Based on our experience guiding families to a successful transition, here are 7 warning signs you are headed for serious problems.

What’s the Purpose of All Your Money

Have you ever wondered why you have the money you have? You have means but what is its connection to meaning? To put it simply, what is the purpose of your money?

Mitch Anthony of Advisor Insights is a leading trainer for Financial Advisors. A month ago, I spoke at a national conference Mitch was speaking at. I gleaned some important insights from Mitch that I want to pass along.

The most common question I hear from clients is “Will I/do I have enough?” The answer to this question is something we regularly monitor for our clients. Mitch suggests a more valuable question to ask is “Am I managing my money in a way that is improving my life?” This requires the holistic approach our firm provides by addressing investment management, debt management, spending management, risk management, relational management, and financial & estate planning.

Are You Leaving a Fraction of What You Could?

Our self-made, independent, North American lifestyle results in each generation basically starting over. Out of ignorance, we make the same mistakes of past generations and miss the incredible wisdom from the life lessons of those generations

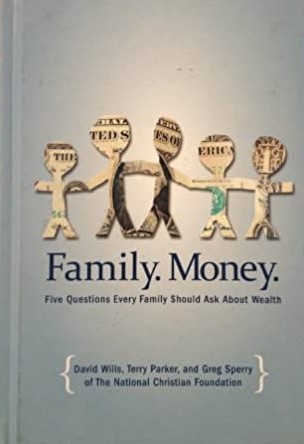

Family. Money. by Greg Wills, David & Parker, Terry & Sperry – National Christian Foundation

Written from a Christian worldview, this book outlines the dynamics of family money & how to avoid the common pitfalls of wealth & inheritance. This is a thought-provoking book from 3 of the country’s leading experts on wealth transfer, David Wills, Terry Parker, and Greg Sperry.

Are You the Greatest Risk to Your Net Worth

Chances are, if you died today, your net worth would drop like a rock. If most of your net worth is in a family business and/or real estate, the value your family receives could be 50% or less than what you expect.

- Page 1 of 2

- 1

- 2