What we can learn from canada's richest families

I was on a webinar recently that featured Paul Desmarais III. Paul is the Chairman & CEO of Sagard Holdings ULC and SVP Power Corp. The Desmarais family is one of the richest families in Canada. Three things stood out for me:

- Where they are investing their family money

- What they find important in an asset manager

- How important it is to overcome the 90/10 Rule

Sagard Holdings is an alternative asset manager catering to ultra high net worth families, their minimum investment threshold is $10,000,000. They focus on investing in private companies, lending to private companies, and building innovative companies. Paul stated they are reallocating from public markets to private markets to get return that is not available in the public markets.

For years we have been helping our clients invest in alternative, or non-traditional, investments. Ultra high net worth families and university endowments have been utilizing these asset classes for decades to preserve and grow their wealth. Typically, these investments do not swing with, or like, the stock and bond markets and growth opportunities can be superior to these public markets. These investments are starting to be less exclusive but are still mainly offered to higher net worth investors.

If you are new to alternative investments here are four things to watch for:

- Avoid publicly traded alternative investments. Some products are made up of private opportunities but trade on the public stock markets. The problem with this structure is the underlying investments do not swing with the public markets, but they are sold via the stock market and therefore will swing with the stock markets. To avoid market-based volatility, you must access investments that are not traded on the public markets.

- Find a portfolio management firm that has experience and a solid track record. Identifying opportunities in the private markets is different from investing in public markets. You may be new to these investments, but it is critical that your investment manager is a seasoned pro in this unique space.

- Fiduciary responsibility. These last two points were also made by Paul Desmarais. Work with a firm that has licensing and credentials that require them to have a fiduciary responsibility. This means they are required by securities law to operate in the best interests of their client.

- Work with a firm that does not have competing influences. For example, if another division works on initial public offerings will this influence investment holdings or recommendations?

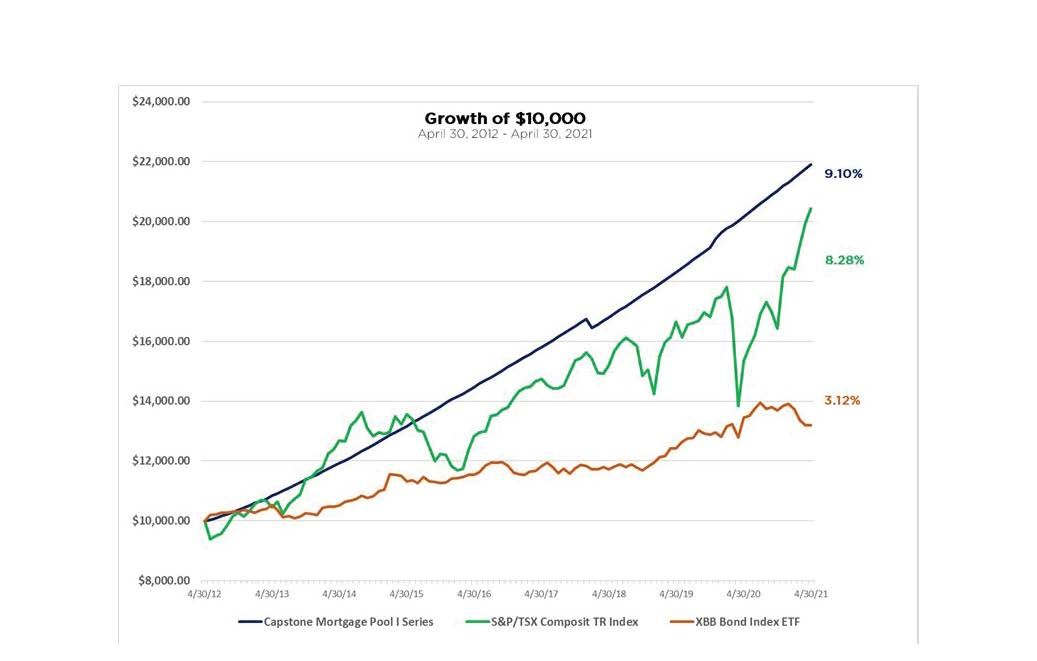

Below is an example of an alternative investment that is not tied to public market performance or volatility. Our clients have enjoyed the results for the last 9 years. You can see that even though it is a fixed income investment it far exceeds the return of the bond markets; in fact, it even outperformed the equity market and with much less volatility. This particular investment is comprised of construction mortgages. Our portfolio manager also has pools that loan to private companies, have equity positions in private companies, and other opportunities.

I have previously written about the 90/10 Rule (The Most Important Discovery I've Made In The Last Decade), which states 90% of a high net worth family’s assets will not make it to the 4th generation. History has proven this rule. Unfortunately, this will be your destiny unless you do some proactive planning to change your course. Future generations are not positioned to build from where their predecessor's left off. A google search of Canada’s richest families will show you families that have retained family wealth advisors to help them pass values, responsibility, skills, success principles, and valuables in a manner that builds a multigenerational legacy.

It is empowering to see how some of Canada’s richest families are investing. If you want to learn more about alternative investments or overcoming the 90/10 Rule, contact us today.

- This is not on offering of securities.

- The performance figures stated above do not include management fees or other fees that may be applicable.

- The information Memorandum and subscription documents contain important information about the risks, fees, expenses and liquidity restrictions associated with Capstone Mortgage Pool I Series.

- All investors must be accredited or be able to rely upon another prospectus exemption.

- Tim Jenkins is a Dealing Representative of Capstone Asset Management Inc.