Volatility is Optional for High Net Worth Investors

Are you tired of volatile equity markets? Want to escape the losses in your fixed income investments? If your investment portfolio exceeds $1M you can avoid the volatile equity markets, avoid losses in fixed income and generate solid, stable returns. Ultra-high-net-worth investors and institutional investors have been doing this for decades with non-traditional investments. This asset class is specifically designed to not swing with or like stocks, bonds, or mutual funds and ETFs made up of stocks and bonds. In the past, these non-traditional investments required a portfolio of millions, today they have a much lower threshold.

The May 3, 2022 edition of the Investment Executive had an article entitled "Economic conditions creating strong opportunities for alternatives". The article goes on to say "Diversification, inflation protection, income enhancement and capital preservation are compelling reasons to invest in alternatives." (Alternative investments is another description for non-traditional investments)

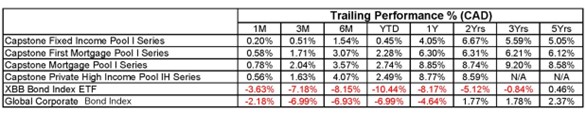

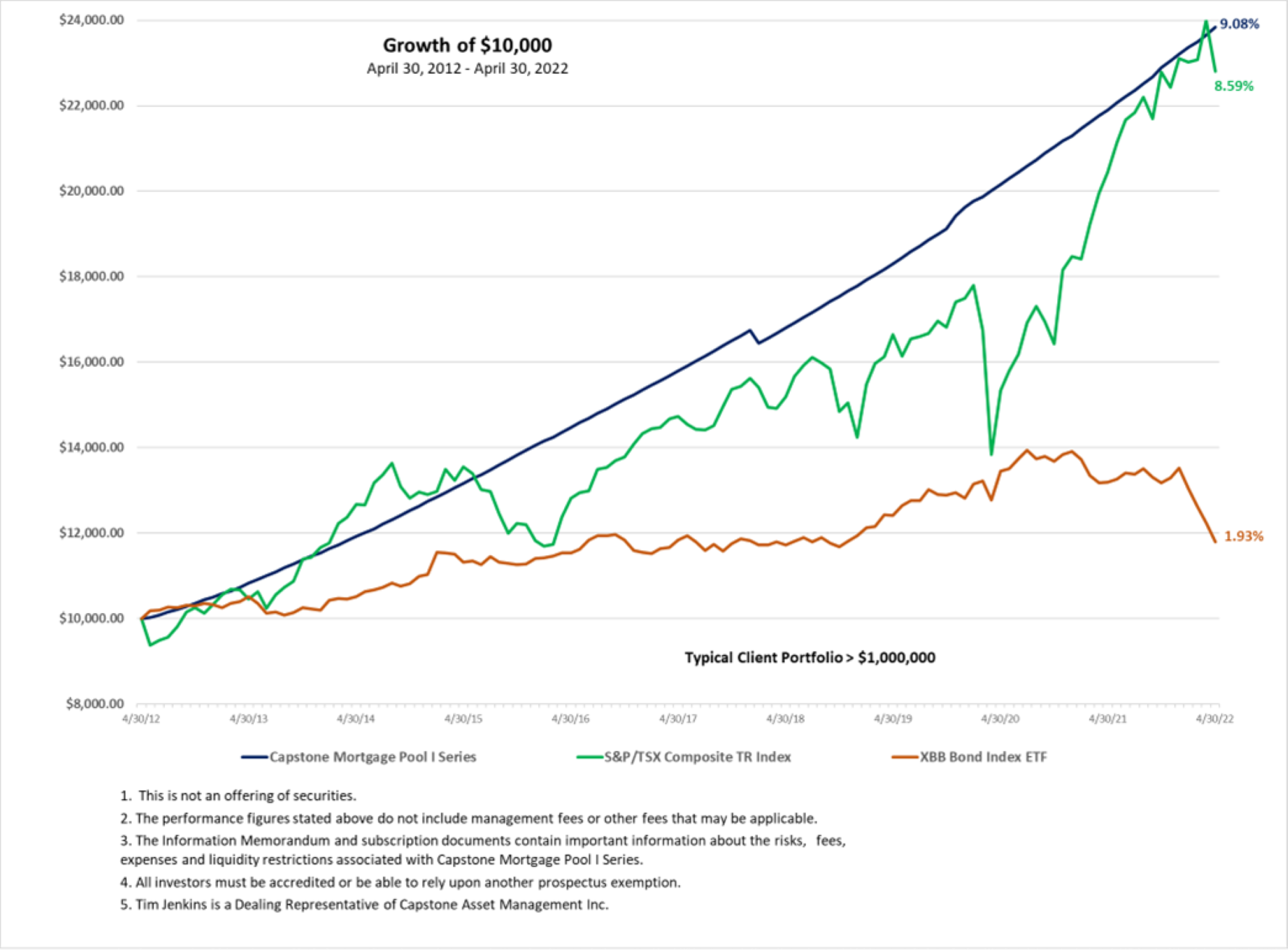

Below is a sample of a few of the non-traditional investments our clients are enjoying. Recent client conversations have often started with "I am so glad we are not in the markets". The chart below provides returns of two fixed income indexes (experiencing losses) as well as four different fixed income alternatives with varying risk and content. The graph below compares the Capstone Mortgage Pool over the last 10 years with the TSX. Although the Mortgage Pool is a fixed income product, it has outperformed the equity market and did so with a fraction of the volatility of even the bond market. The performance speaks for itself.

If you are tired of losses and volatility, let’s schedule a conversation.

Fixed Income Non Traditional versus Traditional