Three Steps To Eliminate Stress from Your Portfolio

"I have absolutely no concerns about our financial future". This was the unsolicited response at the end of a recent client review. This client is a more sophisticated investor with a long history of investing in many types of investments. They have owned a high percentage of stocks in the past but have not been comfortable with the stock market multiples for a while. As a result, we positioned their allocation to be growth oriented but to exclude stock exposure. They have experienced solid growth across all time periods and are incredibly happy.

"I am so grateful for what your team does, I never worry about my investments". This client is retired and on their own, they have been a client for over a decade. During their recent review they teared up when we reviewed positive short and long-term returns and the actual dollar value those returns equated to. For clarity, I asked where the emotion was coming from and received the above reply. Joy and gratitude were stirring the emotions.

These experiences stand in stark contrast to the fear that many investors have faced over the last year as well as during the COVID market pull back in the spring of 2020. It made me ask the question, why are these investors full of peace when so many are full of stress and sleepless nights. Among others, I believe three reasons stand out.

1. They know they are on track for the financial future they desire.

We help our clients answer a critical question, "Do we have enough?" We prepare financial projections for each client confirming they already have enough or what they need to do to have the financial future they desire. Part of our review process tracks how they are doing relative to their plan. They have peace of mind knowing they are on track. There is no uncertainty and the accompanying stress.

2. Their allocation matches their comfort and their financial projections

We evaluate risk in at least three ways. In addition, having the financial projections shows clients the level of risk they need to take to achieve the future they want. They are able to determine what is appropriate given their tolerance for risk as well as their need to take risk. Often the projections confirm clients do not need to take a great deal of risk. The key is clients make decisions based on knowledge.

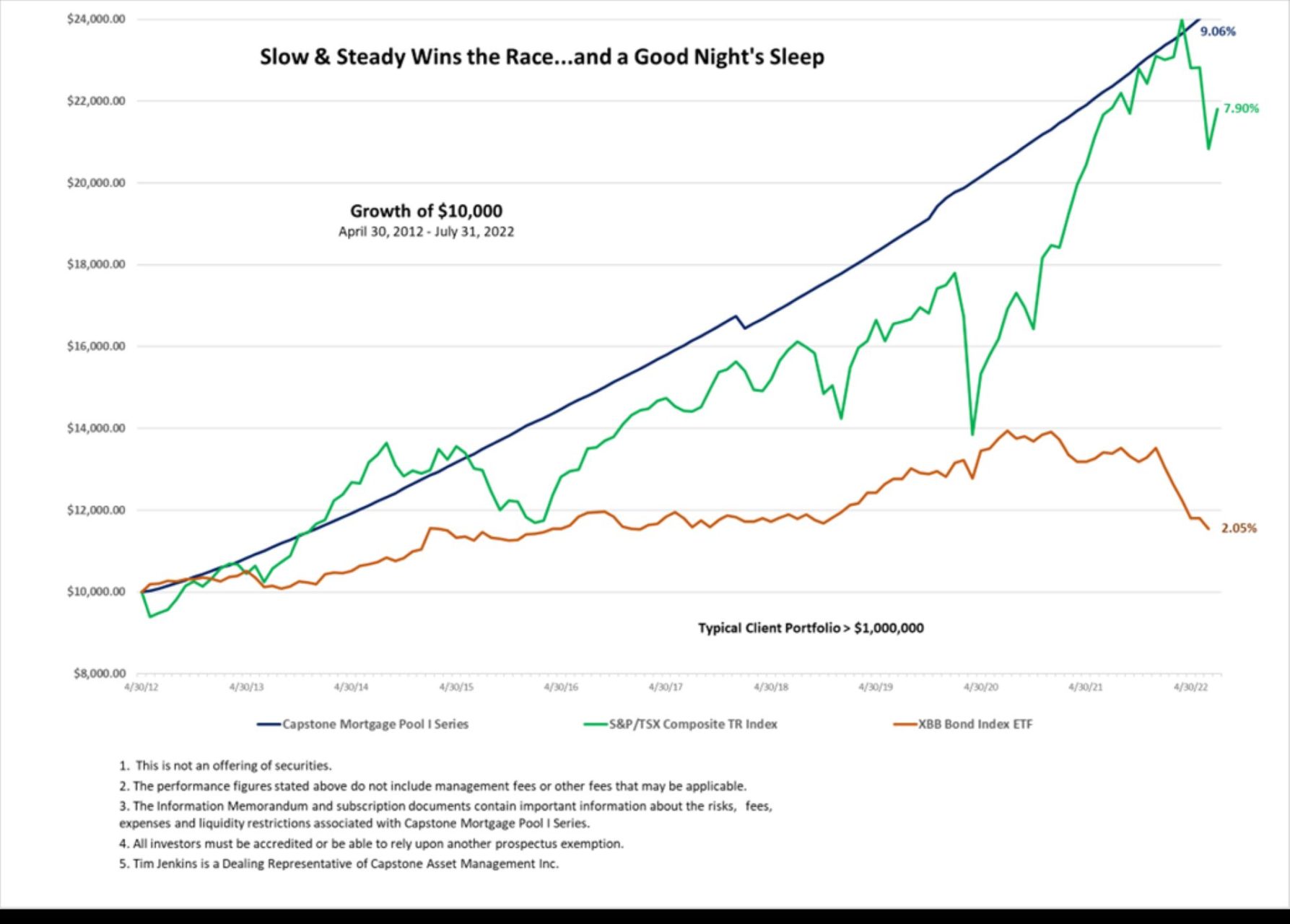

3. They utilize investments that do not swing like or with the stock and bond markets

We offer clients investment opportunities that have been used by university endowments and high net worth families for decades. Investments that are designed to provide consistent performance and are not priced by the second and therefore susceptible to the emotion of the latest breaking news. Below you will see an example of one such investment and how the return and consistency compare to the stock and bond market indices. Proof that you do not need to expose your hard-earned money to significant volatility to earn solid returns.

If you are a higher net worth investor, volatility is not required for growth. If recent markets are causing you stress, call us today to discuss how you can take three steps and reduce your stress.