How To Eliminate CRA From Your Estate

There is a BIG hole in most individuals’ tax planning – they try to reduce their annual taxes during their lives while rarely considering how much their estate will pay in taxes.

If this isn’t addressed, it can often lead to hundreds of thousands of dollars in taxes… sometimes millions of dollars in taxes. Sometimes the family cottage or other important assets must be sold to obtain the money to pay the taxes.

If you and your spouse had died yesterday, how much of your estate would Canada Revenue Agency (CRA) receive?

This is likely a big number and a significant percentage of your net worth. It’s critical you know this number and decide if you agree with CRA inserting themselves in your estate. I have yet to meet someone who knew this number before they were a client.

When the first spouse passes, their assets typically pass to their spouse on a tax-free basis. Your spouse gets your assets, and no tax is paid (there could be some exceptions but generally this is the case). However, on the death of the surviving spouse there will be tax due. Here’s the bad news, 100% of the RRSP and/or RRIF accounts will be treated as income on the day of death. This is now the total of both spouses’ accounts as they were likely combined on the first death so it could easily be $100,000’s. All of it is treated as income so you are quickly in the top tax bracket of around 50%.

ADD to this, 50% of the gains (current market value less the adjusted cost base) on all real estate owned personally which will be taxed at your marginal tax rate (the 50%+). Real estate gains can easily be $100,000’s [the property you claim as your principal residence exemption would not be included in this gain calculation].

ADD to this, 50% of the gains on any non-registered investment accounts which will be taxed at your marginal tax rate (we’re assuming 50%+).

If you own private company shares you better make sure you are sitting down and make sure you have taken all your meds for the day. Shareholders need to ADD 50% of the gains (current value less the adjusted cost base) of your private company shares which will be taxed at your marginal tax rate. The gains could be in the $1,000,000’s if you have not completed proactive planning. You can shelter some of the gains using your Capital Gains Exemption, if it has not been utilized, which will help but may not eliminate all the gains that will be taxable.

It's likely going to get worse. Parliament is hinting at increasing the percentage of these capital gains that will become taxable income from 50% to 75% of the gain.

At this point, the only assets CRA does not have their hands on are your principal residence, your Tax-Free Savings Accounts (TFSA), and likely, your life insurance proceeds.

If you don’t like this reality, you have two options. Don’t die, or do proactive estate planning to determine how much CRA is getting, and if you don’t like the amount, put the proper plans and documents in place to ensure CRA only gets what you want them to get. For the most part you can’t do the planning if you die first.

Higher net worth families have the benefit that their net worth exceeds what they need to fund their future and to bless their children. There is a healthy limit to both, which we discussed in How Much Is Enough and How Much Is Enough for Your Children. Once the amounts are determined through comprehensive planning, families often decide to allocate some of the surplus to their favourite charities. These gifts will make a massive difference for the charities and reduce or eliminate the tax bill due on the second spouse’s passing. You are moving your assets from CRA’s hand and placing them in the hands of your favourite charities. You also have the option to consider if life insurance is a cost-effective method to fund some or all the taxes or charitable gift on the second death.

If you have not completed proactive estate planning, CRA is likely a significant beneficiary of your estate. The good news is you get to choose if they stay there and to what extent. But you must put proper plans in place to take control.

Are you content to write a huge cheque to CRA? If so, is the cash available?

If not, click the “schedule a conversation” button below and get ready to eliminate one of your biggest financial liabilities.

Here are two examples to give you an idea of what you may be choosing to give to CRA..

Case Study 1

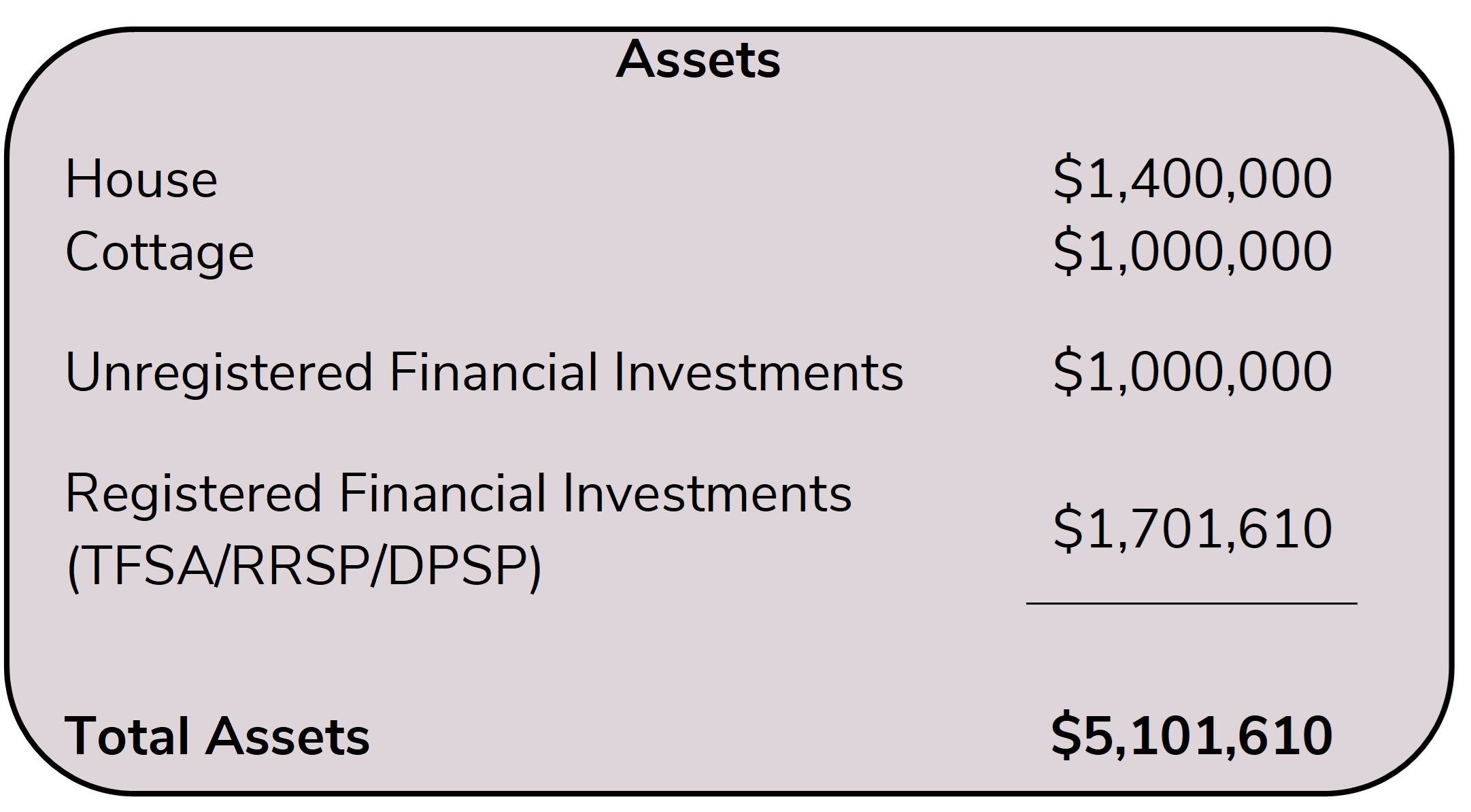

A couple has a house, and a cottage they bought for $250,000 20 years ago that is now worth $1,000,000. They also own registered and unregistered investments. The following details their net worth:

The tax implications on the second death would be the following for this couple:

- Estimated taxes owing at death right now - $1,084,806 or 21% of their estate

- Estimated taxes owing in 10 years - $1,653,841 or 26% of their estate

- Estimated taxes owing in 20 years - $1,444,986 or 23% of their estate

Case Study 2

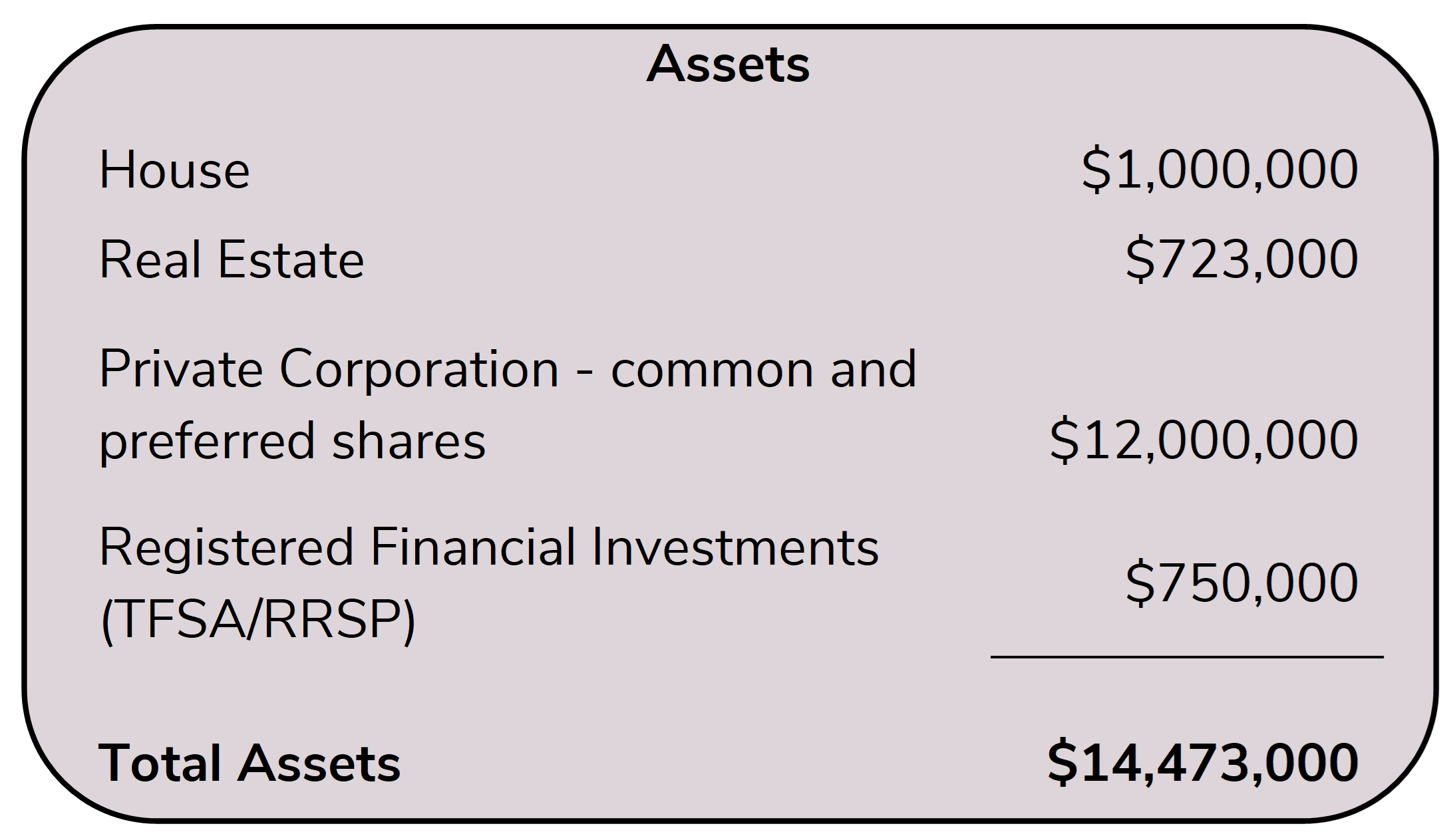

A couple has a successful business that they have worked hard to build. They own their own home and have bought some additional real estate as an investment. This real estate has doubled in value from the time they purchased it. They also hold some registered investments. The following is their net worth:

The tax implications on the second death would be the following for this couple:

- Estimated taxes owing at death right now - $3,580,000 or 23% of their estate

- Estimated taxes owing in 10 years - $4,000,000 or 22.5% of their estate

- Estimated taxes owing in 20 years - $4,000,000 or 22% of their estate

If you and your spouse how much of your estate would CRA receive?

Disclosure regarding legal and tax related services: Trinity Family Wealth Advisors does not practice law or provide tax or legal opinions or advice.