How To Drastically Reduce the Potential for Losses in Your Portfolio

After more than a quarter century in the investment industry I’ve witnessed lots of volatility in the markets. Investors that had quality investments and were patient to stay invested made good returns over the long term. However, it is never enjoyable to discuss negative returns with a client, even a knowledgeable, patient investor. That landscape changed significantly over a decade ago when we started using alternative or “non-traditional” investments. The introduction of these investments into our clients’ accounts has significantly reduced volatility.

Non-Traditional investments are created with asset classes and/or a structure such that the investment does not swing with or like publicly traded stocks and bonds. They have been used for decades by investors such as large university endowments and ultra high net worth families. A great deal of research has been done by Yale & Harvard regarding their multi-billion dollar endowment funds and their allocation to non-traditional investments. Their above average returns have been attributed, in part, to the large allocation to non-traditional investments. I wrote about how Ultra High Net Worth (UHNW) families have been increasing their already high allocation to alternative investments https://trinityfamilywealth.ca/What We Can Learn from Canada's Richest Families. The good news is that non-traditional investments are available through Capstone funds to investors with portfolios in the million dollar range.

Although we can’t predict the future, governments and central banks are telling us their intentions. We have been told higher interest rates are coming to help address increasing inflation rates. Governments have also said they can not continue to influence stock and bond markets with their purchases and will be cutting back. Both steps will produce a difficult environment for stocks and bonds. This could be an ideal time to follow Yale, Harvard and UHNW investors and enjoy a significant allocation to non-traditional investments.

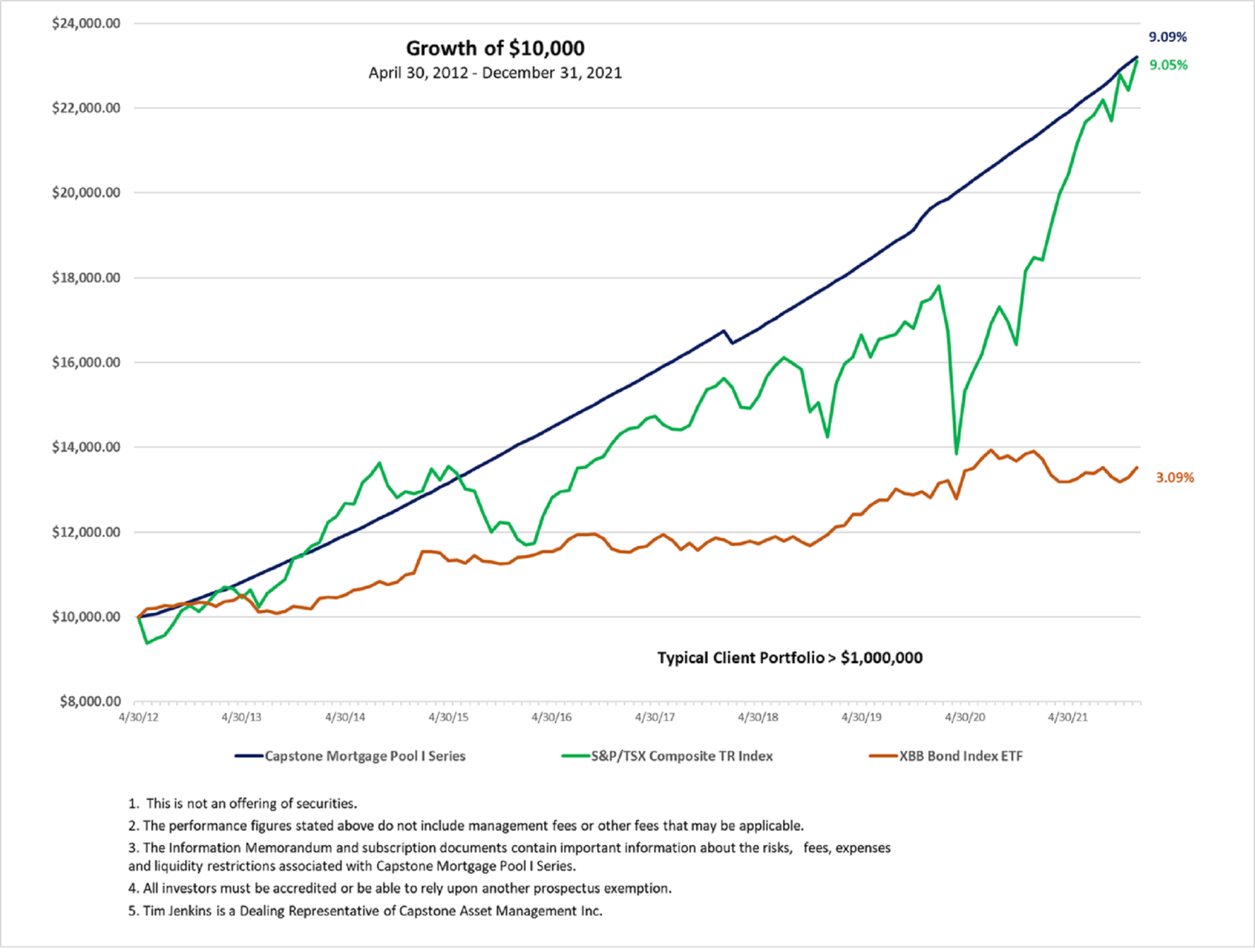

Below you will see one example of a non-traditional investment – Capstone Mortgage Pool (CMP). This is a fixed income product that has rivaled the Toronto Stock Exchange Index (TSX TR) in terms of return since inception. (Figure 1) Our clients have enjoyed gains comparable to the TSX without the volatility. As mentioned above, non-traditional investments are designed not to swing with or like stocks and bonds; below you will see the impact of the onset of COVID on various asset classes. The XBB bond index has subsequently experienced additional volatility and negative performance as you can see in Figure 1. (Figure 2) CMP is a great example of how higher net worth investors can reduce their potential volatility while maintaining the opportunity for return.

Figure 1

Figure 2